Homeowners depreciation calculator

The calculator should be used as a general guide only. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

This limit is reduced by the amount by which the cost of.

. There are several options to calculate depreciation. Non-ACRS Rules Introduces Basic Concepts of Depreciation. The most straightforward one typically used for home improvements is the straight-line method.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Under most insurance policies claim reimbursement begins with an initial payment for the Actual Cash Value ACV of your damage. The MACRS Depreciation Calculator uses the following basic formula.

This depreciation calculator is for calculating the depreciation schedule of an asset. You can find homeowners depreciation calculators online to help you with this. A deck valued at 10000 might depreciate 500 per year.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. There are many variables which can affect an items life expectancy that should be taken into consideration. Also includes a specialized real estate property calculator.

The calculator should be used as a general guide only. Cheapest Home Insurance Quotes Across the US. D i C R i.

This loss in value is commonly known as depreciation. Where A is the value of the home after n years P is the purchase amount R is the annual percentage. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to.

There are many variables which can affect an items life expectancy that should be taken into consideration. How to use the calculator and app. To do it you deduct the.

It provides a couple different methods of depreciation. Section 179 deduction dollar limits. C is the original purchase price or basis of an asset.

See Your Quotes Today. There are many variables which can affect an items life expectancy that should be taken into consideration. Ad Compare 10 Low Cost Insurance Plans For Your Best Options.

The home appreciation calculator uses the following basic formula. First one can choose the straight line method of. A P 1 R100 n.

Checking the Replacement Value If you want more than the actual cash value you need to add. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. If an accident occurs five years into an established homeowners insurance policy the deck will be valued at 7500.

Where Di is the depreciation in year i. The calculator should be used as a general guide only.

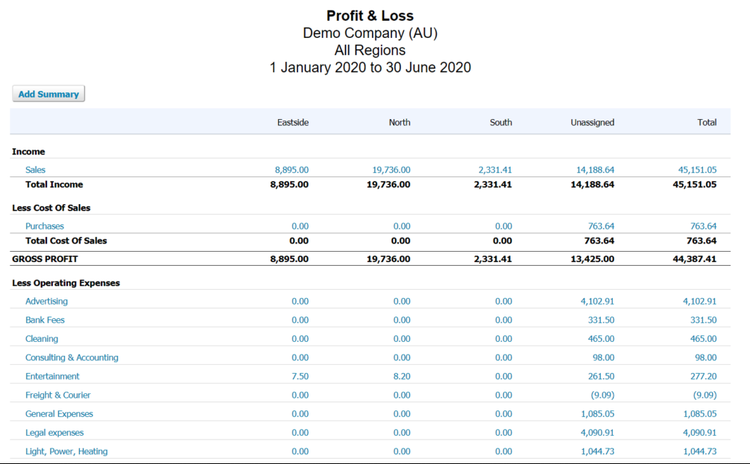

How To Create A Profit And Loss Statement Step By Step

How To Create A Profit And Loss Statement Step By Step

Ultimate Guide For Homeowners Living In A Fire Prone Area

How Segmented Depreciation Can Lower Your Tax Bill Luxury Property Care

Cb Accounting Llc Blog Cb Accounting Llc

Amortization Calculator Credit Karma

Simplified Home Office Deduction Explained Should I Use It

How To Calculate Your Home S Replacement Cost Quotewizard

Types Of Depreciation Financeguru Com

How Is Homeowners Insurance Paid Progressive

Capital Gains Tax On Inherited Properties Damore Law Burlington Ma

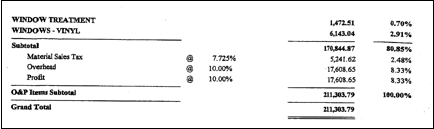

What S Up With Overhead And Profit United Policyholders

I Pinimg Com 136x136 38 Fa Cc 38facc3bf7753f1881ab

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel

Calculators Tools Resources Allstate

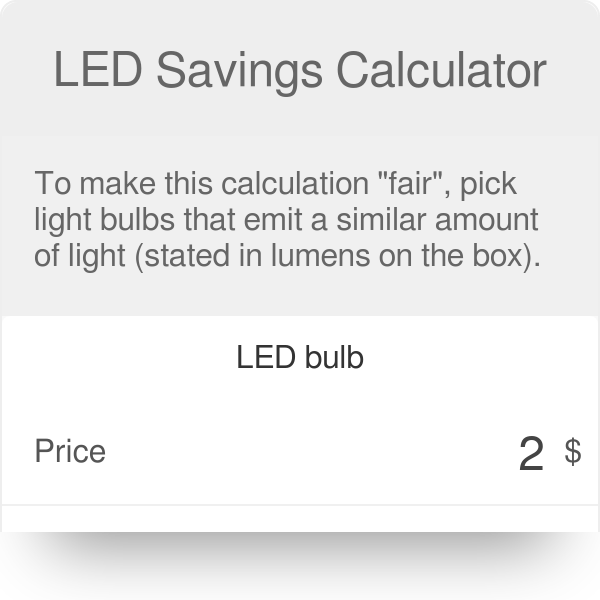

Led Savings Calculator

Real Estate Tips How My Accountant Helped Avoid A Costly Mistake